Is Life Hard For Millennials? Thoughts From a Millennial

Alright millennials, what does it truly mean to be a thriving self-aware millennial adult?

Remember those childhood afternoons spent hunched over a coffee table, deciphering cryptic messages hidden within a bowl of alphabet soup?

Yeah, that feeling of utter confusion?

Welcome to adulting for millennials.

We graduated into a world where the “adulting handbook” seems to be missing crucial chapters.

Society throws terms like “financial stability” and “career success” at us, but the definitions feel frustratingly vague.

Is adulting supposed to involve ramen noodle dinners for a week straight just to afford that avocado toast everyone loves to mock?

To add more fuel to the fire, we have to deal with issues like student loans, delayed adulthood, rising house costs, and more.

And if this wasn’t enough, now there’s a “life guru” peddling their version of the perfect life at us everywhere we turn.

A life that promises a six-figure salary, a picture-perfect Instagram feed, and a corner office overlooking a bustling cityscape.

All of this made us feel as if success was like a foreign language.

But somewhere down this mess, we Millennials started to rebel and wonder:

Is there room in this “adulting handbook” for a version that prioritizes mental health, side hustles, and a work-life balance that doesn’t feel like a constant tightrope walk?

Can we have the life we want despite these hurdles in front of us?

As a Millennial, I’m attempting to answer that in this post.

Let’s get going!

Idea 1: The Economic Landscape for Millennials

Millennials and Student Loans

How about we start a conversation about something we all hate? Student loans!

Student loan is the elephant in the room, or should I say, the burdensome backpack most of us are carrying.

A recent study showed that Millennials carry approximately 30.26% of the total student loan debt.

That’s a lot and it’s enough to make anyone feel like they’re stuck in a financial insecurity!

The funny thing is that we’re a generation of dreamers and doers, and we were sold a dream that came with a hefty price tag.

College degrees were supposed to be the golden ticket to a secure future, but for many of us, it felt more like a one-way ticket to Debtville!

When we’re young and ambitious, the long-term consequences of debt can seem fuzzy.

We focus on the immediate benefit – landing that dream job.

But fast forward a few years, and that fuzzy feeling turns to a full-blown financial fog.

One of the biggest ways these loans impact us is by wrecking havoc on our career choices.

Remember that wide-eyed freshman with dreams of becoming an established author?

Yeah, those dreams get a reality check when the loan repayments come knocking.

Suddenly, that passion project of saving baby pandas seems a lot less feasible when compared to the stability of a high-paying corporate gig.

Financial goals take a nosedive too.

Things like homeownership would seem hard where a big chunk of our income goes straight to reduce our student loans.

Investing in that retirement fund becomes a distant fantasy, replaced by the immediate need for ramen noodles.

But here’s the kicker:

While student loans undeniably impact our choices, it doesn’t necessarily mean it’s doom and gloom.

Some studies show that Millennials are still ambitious and goal-oriented.

We might have to be more creative and strategic, but hey, that’s kind of our millennial superpower, right?

The point is, student loans can feel like a life sentence of financial purgatory.

But before you throw in the towel on your dreams, remember, we’re a resourceful bunch.

The question is:

how do we navigate this complex situation?

Luckily, there are a few ways you can deploy.

I’m not a financial advisor nor I’m going to sell you anything.

So, I’d advise you to do your research on how to pay your loans.

But, there are a few ways you might consider checking out if you’re in the US:

- Price water house Coopers (PwC):

PwC offers up to $1,200 per year towards student loans, with a total contribution of up to $10,000.

They help you if you are employed to save up to three years on the life of your student loans. - SoFi:

This personal finance company provides you $200 a month in loan reimbursement to pay your loans. Works if you are employed. - Staples:

Staples rewards its top performers with $100 per month of student loan repayment help for up to 36 months, applied to the loan principal. - The U.S. Government:

This one only works if you work for the government.

Through the Federal Student Loan Repayment program, you may receive up to $10,000 per year and a lifetime maximum of $60,000 towards student loan repayment, specifically for federal student loans.

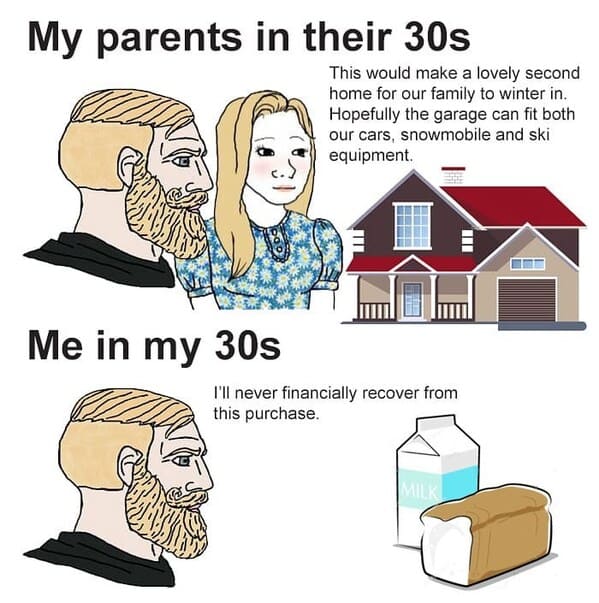

Rising Housing Costs: A Millennial Struggle

One of the biggest financial hurdles we Millennials face is the soaring cost of housing.

Want to hear a Millennial joke? Affordable housing.

That’s the punchline because it doesn’t exist anymore!

Whether renting or buying, affording a place to live has become difficult for us compared to our parents.

Think about it:

For those of us looking to purchase a home, saving up for a decent down payment can seem like an impossible feat.

The median home price in the U.S. has skyrocketed over 50% in the past decade, far outpacing wage growth.

Entry-level jobs provide relatively low salaries, so putting away $30,000, $40,000 or more for a down payment can take many years of saving.

According to IMB Journal, If you are an American and want to buy a median-priced home, you need an annual income of $166,600,

And this is almost impossible where the median household earns just $74,580.

Even once a down payment is secured, you then have to grapple with rising mortgage rates which make monthly payments far higher than what the previous generations paid.

Did you know that mortgage rates hit historic lows in November 2012 at 3.35%!

But they have climbed sharply in recent years, adding hundreds of dollars to the typical mortgage payment.

For those of us who are unable or unwilling to buy, renting is also becoming expensive in major cities.

Rents have increased at three times the rate of inflation over the past couple of decades.

Many Millennials are stuck paying 30-40% of their income just for housing in urban centers.

So surely this hampers our ability to save or spend on other priorities.

No wonder why many are leaving abroad for better chances. Or living on wheels or remodeled containers (They are better and awesome!!).

So, this rise in housing costs makes building wealth and achieving financial stability more difficult right out of the gates compared to prior generations.

Entering The Workforce During a Recession

Remember that scene in Indiana Jones where Indy has to choose the “holy grail” and ends up grabbing a bag of sand?

Yeah, that’s how entering the workforce felt for many Millennials.

The Great Recession hit just as we were up and ready to conquer the corporate world, leaving us with a job market more desolate than the Sahara.

As you can imagine, this wasn’t exactly the dream launch we envisioned.

Landing a stable, well-paying job suddenly became a unicorn hunt.

Many of us ended up bouncing from gig to gig or taking many jobs that didn’t leverage our potential just to afford basic needs.

Even as the economy recovered, full-time roles with good benefits are still hard to secure for so many.

As a result, some have continued some gigs and side hustles out of habit and financial necessity.

However, there is a blessing in all of this that we have realized:

There is no better financial stability and life than to build decent skillset to start our own business or land a high-paying job in a good company.

Most of us realize now that there is no middle ground for long-term success in life by juggling many low-paying roles.

But, I have to admit that sometimes, the situation demands that beyond our control.

This is especially true if you have a family and you’re the only provider.

So leaving that job becomes more risky.

Idea 2: Millennials Mindset Shift

Ah, the good ol’ Millennial life script:

College degree, secure job, white picket fence (a term that represents the American dream of a comfortable, traditional suburban life), 2.5 kids, traveling and making a change.

Sounds amazing, right? Except for the part where reality rarely cooperates.

Thanks to student loans, shaky economies, and the ever-rising cost of living, we are finding ourselves hitting the pause button on those traditional milestones.

Homeownership? More like renting forever.

Starting a family? Maybe later, if ever.

These delays can leave us feeling like we’re falling behind in some cosmic race.

Societal expectations can pile on the pressure, making us feel like such dreams are unreachable.

But the silver lining here is that we have realized something:

delaying such milestones doesn’t have to be a bad thing.

Studies have shown that despite the wait, we still value commitment and stability.

We just might be defining those terms on our own time.

But, the emotional toll of this shift can’t be ignored though.

I saw some of Millennials and Gen Z as well compare themselves to the “keeping up with the Joneses” version of success.

This can be a real downer.

However, the great thing about us Millennials and Gen Z is that:

we’re a generation that’s comfortable with change.

We changed the script and added our own makeover to it.

Instead of the white picket fence, we are now chasing experiences and personal fulfillment.

We still want a family at some point.

But for now, our family might look different – a chosen close friends or a smaller, later-in-life clan.

The point is, our timelines don’t have to match the outdated script.

There’s no one-size-fits-all approach to success.

We’re redefining what it means to “have it all,” and that can be pretty darn empowering.

Idea 3: Millennials Values Are Reshaping The Game

We Millennials are driven by a different set of values. (Learn more about Millennials values).

These values are fundamentally changing the game when it comes to our careers and finances.

For us, purpose trumps prestige. But we want mostly both in our terms.

We crave work that aligns with our interests and values.

Sure, a good paycheck is important, but it’s not the only factor.

Work-life balance is a top priority – we want careers that allow us to be mentally healthy as we keep grinding through it all.

This focus on purpose impacts many aspects of our life like our financial decisions and dating to name a few.

We might be willing to take a pay cut for a job that ignites our souls.

Fancy cars and McMansions? Not necessarily our cup of tea for now.

Experiences and travel might hold more value than material possessions that we can get if we keep doing what we love and getting paid a lot for it.

Surely, there is nothing wrong with having cars and mansions around, but you get my point.

Now, some might call us a bunch of naive idealists.

But here’s the thing:

studies suggest a surprising benefit to this values-driven approach.

Employees who find meaning in their work tend to be more engaged, productive, and loyal.

The same applies if you are doing something you’re interested in.

These are all criteria for long-term success.

That’s why, most companies with a healthy culture are starting to take notice, creating work environments that cater to Millennial values and Gen Z alike.

This shift isn’t without its challenges.

Finding a job that perfectly aligns with our passions can be a tall order.

We understand that.

Thankfully, the recent few years after the pandemic have made living with purpose and pushing for a stable life more possible.

Such a shift in work-life dynamics has helped us create a life that challenges the status quo.

And this serves as a perfect slide to the next section.

Idea 4: Resiliency, Entrepreneurship and Adaptation for Millennials

Faced with a challenging economic landscape, we aren’t just sitting back and taking it on the chin.

We’re channeling our inner MacGyvers and hacking the hustle with a surge in entrepreneurship and innovation.

Remember that cramped job market we talked about earlier?

Well, many of us are saying “screw it, I’m better off doing my own thing”.

From that fashion influencer selling her own clothing line to the Twitch streamer with a legion of paid subscribers to the artisan running a thriving Etsy store.

A millennial entrepreneur is capitalizing on virtually every niche interest and market demand.

This isn’t just about side hustles, though.

As a result of simply redefining the rules, I think we alongside Gen Z are reshaping what it means to be successful at this age.

Oladosu Teyibo, Culted, The Stack World, Darmo Art gallery and more are a few examples of successful companies led by Millennial and Gen Z founders.

These businesses aren’t just about just making money – they’re also creating a better world that reflects the values their founders have and care about the most.

Finally, I think another factor that may have contributed to such shift is that we have seen how colleges failed us in many ways.

We found shelter in online education that made what we wanted to learn fairly easier, more practical and cheaper compared to these colleges.

And I can’t forget the ultimate currency that made so many things possible; a like-minded community.

Thanks to social media, these communities offer us a space to share struggles, celebrate successes, and learn from each other’s experiences.

This peer support system is invaluable.

It reminds us that we’re not alone in facing these challenges and that we can do more.

Hey, sometimes just knowing someone else gets it can be a game-changer.

And for many of us, that’s the potential of starting something great!

And finally, it’s never too late to live the life you want.

Start small and figure out what sacrifices you’re willing to make for each goal.

Things will be overwhelming for a bit, but trust me, the feeling is unbelievably enriching!

So consider this your official admission slip to toss out the outdated adulting rulebook and create your own masterpiece of a life.

“The only person you are destined to become is the person you decide to be.”

– Ralph Waldo Emerson

Thanks for reading!

Did I miss something? And what do you think about it?

If you could remove an issue from your life, what would it be?

Let me know in the comment section below.

Until next time 🙂